Call us Toll free: 1-888-LARIBA-1

The Economic and Monetary System in Islam

ZAKAH

(COMPULSORY ALMS GIVING)

The Riba-Free Islamic Monetary and Economic System is Base on Three pillars:

1. Zakah – The Worship of Purifying One’s Assets and Savings by paying out the Right of God into such assets

2. Miraath or The System of Inheritance which defines the distribution of assets to the deceased’ heirs as revealed in Chap. 4 of the Qur’aan

3. Riba Free -RF - Money & the Monetary System, which is based on using Gold and/or Silver as reference monetary base.

We shall focus here on Zakah.

ZAKAH:

Zakah is a REQUIRED ritual and act of worship onto each Muslim head of a household. Its purposes are:

- Mutual caring and support between members of the community rich and poor,

- Purifying the self, the soul and the assets of each household, and

- Elevating the purity and excellence of the spiritual soul.

Zakah is required from a Muslim as Shahadah; The witnessing that we believe only in one God/Allah and in the authenticity of all God’s Prophets from Prophets Abraham to Ishmael and Isaac and in all those who followed them including Prophets Moses (s), Jesus (s) and Muhammad (s.)

Zakah represents the backbone of the Islamic Economic System. In fact, (S) Abu-Bakr, the first Caliph who assumed the running of the State after Prophet Muhammad (S), waged a campaign to capture those who refused to pay Zakah after the death of Prophet Muhammad (s) and put them on trial.

Zakah may be looked upon as penalty which reduces one’s assets when it is paid out. The Prophet Muhammad (s) teaches that your assets NEVER go down because of paying Zakah and the Qur’aan teaches us that it is one of the BEST investments a Muslim have. The return on investment is 700 times the original investment (see Qur’aan Chap2 (Al-Baqara) Verse 261)

Zakah system and methods are designed to gather its dues to accumulate assets in the Treasury of the Community/Nation and reinvest it back in the Community.

The following is how one calculates how much Zakah One Owes

HOW TO CALCULATE ZAKAH:

Estimate How much Assets Do you Own – Averaged from Ramadan Last Year to Ramadan This Year? Here are the Categories of Assets:

- Cash Savings,

- Real Estate Properties BUT NOT YOUR HOUSE / PRIMARY RESIDENCE,

- Cars but NOT your Primary Car,

- Inventory,

- Business Value

- Other like Jewelry

If the value of all these assets is Equal to or MORE than a minimum (Nisaab) of 3 Ounces of Gold or 22 Ounces of Silver. At a Gold price of $1700 per ounce (April 2020), then the Nisaab is $5,700. Then, YOU HAVE TO PAY ZAKAH. The ZAKAH is calculated on the whole amount not on the amount that is above $5,700.

Rules Followed in Calculation of Zakah:

Amount of Zakah is NOT BASED on INCOME like in income tax calculation. It is based on assets that are held for a full year and if total assets are above the Nisab.

If your assets are invested Riba Free (Shari’aa Compliant) then you do not pay Zakah on the value of the asset but on the income/profit generated from the investment of these asset. The ZAKAH system is designed to encourage the rich NOT to amass their saving in cash and to motivate them to INVEST it back in the Community to generate job opportunities, prosperity & economic growth.

- Zakah on Cash in Savings, Checking Accounts and in possession, 2.5%

- Investments:

- Dividend Income from Riba-Free Investing, 10%

- Net Income from Rental Properties. 10%

- Capital Gains from sale of Properties/Stocks. 10%

- Portion of Retirement Plan Distribution Representing Profits over the Year.10%

- Net Income from Land:

- Irrigated by Rain. 10%

- Irrigated by Rivers. 5%

- From Reclaimed Deserts & Lands. 2.5%

- Owned Natural Resources:

- Oil and Gas. 20%

- Other Natural Resources. 20%

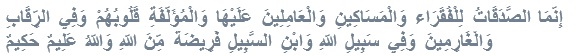

Who Are Entitled to Receive the Money from THE ZAKAH Fund in the Treasury: (Please see Qur’aan Chap # 9 (Surah Taubah - Repentance) verse # 60.

1. The Poor: Defined as those who cannot afford to even feed or cloth themselves. The purpose of paying the Zakah is two folds. First is the short-term goal of feeding & clothing them Then, the log-term goal of teaching them a profession that can help them get employed like learning how to drive a taxi and to work as a taxi driver,

2. The Needy: Defined as those who receive income but that income is not sufficient. An example is a low-income taxi driver who does not own a car but leases it through another owner because he, the needy, cannot get credit. So, the needy is given a credit to own a taxi and drive it & eventually grows to own other taxis that would hire the poor in category 1 above and raise his/her status from a poor to status 2 here or a needy.

3. Zakah Collectors, Administrators and Portfolio Managers,

4. Those Who Need to Be Brought Closer to the Community to Build Bridges Between Them and the Community in an effort to create a united, prosperous and peaceful community regardless of faith, color, national origin, political orientation, gender and/or language,

5. Freeing the Slaves: in order to free them from their shackles’ and to help them attain freedom and liberty. This applies to many dictatorships that enslaves its people,

6. The Heavily Indebted: Due to unfortunate circumstances that are out of their hands,

7. The way of God/Allah: That can be any charitable effort to please God/Allah like building a school, a place of worship, helping a student, helping a new immigrants etc

8. The Travelers: These are newcomers and travelers who move to new locations or travel to establish new contacts, relationships, businesses and/or markets. This money can be used to build hostels, hotels, facilities that would make it easier for people to travel, get to know the world and feel at peace doing it. It is interesting to note that each outlet represents 12.5% of the total Zakah collected. If an outlet does not need the money then money is redistributed as needed.

Updated 05-2020