1. How Much Down Payment is required?

We have several financing programs with down payment that start from 3% to 5%. The nature of the financing and how the property will be used by the Clients determine the minimum required down payment.

If the down payment is less than 20%, regulations require that you sign up for PMI (Private Mortgage Insurance). We recommend that clients – if they can afford it - put at least 20% when possible, to avoid payment of Private Mortgage Insurance (PMI.)

The GOOD NEWS is that when the value of the house appreciates or if the customer gets a bonus and pays the financing down, the PMI can be removed at about 75 ~ 80% Loan to Value.

2. What is the Relationship Between LARIBA and Freddie Mac / Fannie Mae? Does LARIBA sell its client’s loans, like in the case of Freddie Mac / Fannie Mae or other Banks?

Freddie Mac (and Fannie Mae) was originally initiated by the US Government to provide liquidity to the housing market, which is the locomotive of growth with many associated industries like cement, bricks, tiles, paints, electric wiring, carpets, appliances, furniture, gardening, etc.

In April 2001, LARIBA was the FIRST RF (Riba Free Islamic) Finance Operation in the West to be develop a Riba Free business model to deal with Freddie Mac. It was approved for investing Freddie Mac’s money using the LARIBA RF Home Finance Unique Model. In 2002, LARIBA became the ONLY US-Based Shari’aa Compliant Riba-Free Finance Company to be approved by Fannie Mae. Fannie Mae is the largest mortgage investor in the world. WE PIONEERED the RF Business Model to deal with Freddie Mac and Fannie Mae. We are happy to see other providers use the same business model we pioneered in 1999.

We thank Allah for these historic achievements and the dedicated quality work of all LARIBA Professionals.

LARIBA DOES NOT BORROW MONEY FROM FREDDIE MAC / FANNIE MAE NOR SELL LOANS.

In our Business Model Freddie Mac / Fannie Mae are treated as investors in the LARIBA Financed Homes. Every single home is presented to Freddie Mac / Fannie Mae for approval or disapproval. If approved, LARIBA would complete the financing from its own funds on behalf of Freddie/Fannie, deliver the financing documents to Freddie/Fannie and is reimbursed within a few days by Freddie Mac / Fannie Mae. Any unintentional interest paid by Freddie/Fannie is segregated to cleanse our income and is paid to a charity.

3. Does LARIBA Actually Own the Property? If “not”, how can they charge “rent”?

The LARIBA Model, "Declining Participation in the Usufruct (DPU),” is based on the financier purchasing the property jointly with the client before selling the financier’s share with the exception of the usufruct for a specific period (Bai’u Al-Ain m’a Istithnaa Al-Manfa’a ). As long as LARIBA owns the shares of the Usufruct, (as expressed by a lien on the property – Milk Al Raqabah) then it is entitled to receive a proportion of the rental value of the property according to its percent ownership level. A full Research Paper published by the TOP Islamic Finance and Banking Academy in the world – ISRA (International Shari’aa Research Academy) – is available. The Academy is run by the Central Bank of Malaysia, and it includes some of the most accomplished scholars in RF (Islamic) Finance.

4. Is the Only Difference in the LARIBA Contract is playing with words by replacing the word “RENT’ for “Interest”?

NO. WE DO NOT CHARGE INTEREST.

In fact, we do exactly the opposite.

LARIBA Residential Property Financing Model “Declining Participation in the Usufruct (DPU)” is a financing model based on:

This model of sale was pioneered by the Prophet (S) when he sold his camel’s title of ownership at the point of sale except for using it to transport him from the point of sale to his home. It is called: Bai’u Al-Ain m’aa Istithna’e Al-Manfa’a:

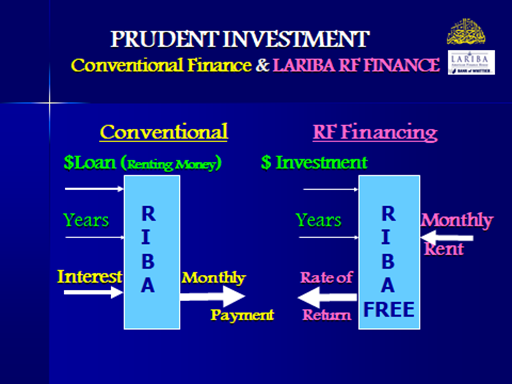

LARIBA RF Finance Model does not start with an interest rate (as Riba is defined as: the renting of money at a price called interest. Interest is the rate of rental of money which is Riba.) The LARIBA RF Finance Model relies on the live market-researched and documented actual rental value of a similar property in the same neighborhood.

In Riba-Based transactions the bank uses an amortization program.

They input:

Output is:

The Monthly payment.

In the LARIBA RF proprietary program, we input:

The unknown Output is

The Rate of Return on investment.

Here we test for the PRUDENCE of investing in this property. We have several scenarios. If the Rate of Return is:

This LARIBA RF Discipline is what saved many LARIBA customers from participating in the US economic price bubble of 2008.

Many may ask: “How can the bank adapt nowadays to the increasing interest rates from the Federal Reserve which also affects the inflation rates?”. In fact, our model takes care of that because it uses the actual live market rent in the active market.

5. Is the LARIBA contract the same as that of a Conventional Riba Bank?

The documentation of a home financing is a standardized system developed in the US since 1920’s and is the most sophisticated and government regulated in the world. In the interest of all parties and to meet the requirements of US government authorities, LARIBA transforms its Model based on property rental into a traditional mortgage but with the explanation of how the monthly payment was calculated.

This is done in the COPY-RIGHTED LARIBA Agreement, which indicates clearly how the monthly payment was calculated based on rental value and that interest is HARAM and is prohibited, and that this is done in order to satisfy the requirements and laws of the US. This also allows the buyer to benefit from tax deductibility.

6. I heard that in your contract you have a term as interest. What does that mean?

We have a very unique and patented system that has captured the admiration of many experts and Shari’aa scholars. While most others take the interest rate of the day and call it rent (Guidance, UIF and Devon), or Index (South Asia, Guidance and some Gulf Banks) we do exactly the opposite! As explained above.

Doing it the way we follow - using standard agreements - assures our brothers and sisters beyond any doubt that they can benefit from tax deductibility. Remember that other contracts, despite being admittedly by those who use Guidance are mere regular finance contracts - had to get an Opinion Letter on Tax deductibility. As you know, Opinion Letters can be reversed retroactively at any time by the authorities BUT NOT the Mortgage Deduction laws! So, metaphorically, it is like trying to attend an important meeting and they require that you bring a bottle of wine. So, a Muslim, who is a minority and who is committed to Allah buys a bottle of grape juice & enters. When they ask what it is he says wine. The problem with what is out there these days is if they take the Wine & call it grape juice.

It has been really sad for me & many other brothers and sisters in the "Live Without Riba Movement for All - Muslims & Non-Muslims". Why? Because we thought that we have succeeded in disengaging the Muslims thinking from thinking in terms of Riba/Interest.

We shall not compromise because we know that we are trying our best using our own resources to be on the side of Allah & His Prophet (s).

So, what is the difference?

What our model is unique about is that it screens out any bubbly market conditions. In N. California a small home may cost $ 1 million but the same home can rent for $2500. So, using the LARIBA Model one can conclude that the return on investment is very low & LARIBA declines financing. That is NOT done by any of the models out there because they rent money, which is RIBA - Al-Riba Bi Ainihi - but we rent homes based on actual documented live market rent.

7. Is the Interest Word used in any of the documents?

Yes. We have an edict (fatwa) given to Albaraka - the oldest Islamic Finance and Banking Group in the world to allow to use the word interest to satisfy the laws of the land with the condition that it is not interest and it is done to avoid breaking any laws.

We use "implied interest", which is calculated based on the actual house rent. It is used to satisfy the Mortgage disclosure regulations and laws. It is also used in order to document the process in order to allow the buyer to claim the mortgage tax deduction. In addition to the traditional financing documents, a LARIBA Agreement is used. This LARIBA agreement discloses that Riba (interest) is PROHIBITED in Islam, that the monthly payment was obtained on the basis of lease-to-purchase model and that the word interest is used to comply with the rules, regulations and laws of the United States Government. This approach has been approved by the TOP Islamic Finance Shari'aa scholars in the world and is documented.

8. How is the LARIBA Model different from Other Models Used by Conventional Riba Banks and Mortgage Companies?

The Conventional Riba Banker and the LARIBA Finance Institution are first concerned with:

Then the process differs drastically.

For the Riba Conventional, if one qualifies the Banker will need to start by defining:

The Conventional Banker inputs the above data in a computer (amortization) program and solves for the Monthly Payment consisting of Repayment of Principal and the interest on the money.

In contrast, the LARIBA Model starts by asking the homebuyer to:

And the LARIBA Finance officer also gets three independent rent estimates for the same house.

This way, the buyer and the LARIBA Finance officer end up with 6 estimates of the rent. They then negotiate what they agree to as a fair rent for the property.

The following is a numerical example that clarifies the differences between the approaches used in riba (conventional) and Islamic financing:

A family wants to buy a house for $300,000. They only have $60,000 of the purchase price. They approach a bank to help them finance the house. The following is a comparison between how the process will likely go in a RIBA Banking setting as compared to Islamic Banking setting:

Riba Conventional Banker:

Islamic LARIBA Banker:

Please note that the resulting “implied” interest rate is not uniformly the same. It differs from one home and/or geographic location to another and it differs based on the leasing rate in the relevant market.

In the LARIBA Islamic Banking environment, the Islamic LARIBA banker encourages the family to pay their home off as fast as they possibly can in order to reduce the burden of debt on the family’s cash flow and free more money to save for the future.

9. What is Interest Rate? How is it determined?

The interest rate is the rental price of money when the Conventional Riba Banker rents it. The Federal Reserve Board of the US or the Central Bank involved defines its level. Government policy makers use it as a tool to manage the economy. The Fed Fund Rate is calculated by adding the Expected Econ Growth rate to the expected inflation rate. It is NOT an interest rate. That is why it is called: The Fed Funds Rate. It is a tool used by the Fed to decide on the amount of money to print and disperse in the market OR the amount of money they want to take away from the market to adjust inflation rates.

10. What is Interest / Riba?

Interest is the rent of money at a price called interest rate. It is called in the Islamic Jurisprudence “Riba” and in the Old Testament “Ribbit”.

Money is fungible. It changes its nature when used like a loaf of bread or an apple. It cannot be rented. When it is given to someone the TITLE of OWNERSHIP is transferredIn a Conventional Riba institution the Riba Banker rents you the money at a rental rate called interest. This interest is defined for all markets regardless of the economic environment of the particular market. In a Riba-free transaction the actual market-defined rental of an actual tangible asset or service is charged. This rent differs from market to market depending on the supply and demand of the tangible asset/property being financed. The LARIBA banker in fact INVESTS jointly with the user of funds while the Riba banker LENDS money to the user of funds. In the LARIBA System we FINANCE and NOT lend. The only loan allowed by the Islamic Jurisprudence is a Loan for Good Cause (Qard Hassan) and is given without interest or added value.

There are two types of Riba:

11. Has the LARIBA Model been approved?

YES.

The Most Recent Fatwa was given by Dr. Abdulbari Mashal who is a distinguished world class scholar, a member of the AAOIFI Organization that issues all Regulations pertaining to Islamic Banking and the Head of the Premier Shari’aa Audit Firm: RAQABA with offices in Raleigh, NC; London, UK and Kuwait.

He was the Shari’aa advisor of the largest Islamic Bank in the world: AL Rajhi Bank in Saudi Arabia. He has authored many research papers and international Islamic Conferences in different aspects of Riba-Free Banking around the world. He is also a Shari’aa Board member of a number of Islamic Banks in the world.

Dr. Mashal authored a pioneering research paper on our model published by the top Research Academy in Islamic Banking operated by the Central Bank of Malaysia – ISRA (International Shari’aa Research Academy). We shall be happy to share it with you if interested.

LRIBA is the ONLY Riba Free (Islamic) Finance Company in America that subjects itself to an ANNUAL Independent Shari’aa Audit and publishes it on its website. The link for the latest audit dated Aug 30, 2022, is: https://www.lariba.com/sitephp/pdf/Shari'a_Audit_Report_2022_English.pdf

It s also important to mention that The LARIBA Financing Model is based on Religious Jurisprudence (Fatwa) and Procedures issued by distinguished scholars (Sheikhs Qaradawi , Dr. Sami Hmoud, Sheikh Al Dhareer, and others) and documented by one of the oldest Islamic Financial Institutions in the world – AlBaraka Banking Group - ABG.

American Finance House LARIBA is run as a professional Riba-Free and Shari’aa Compliant Islamic Finance company. It is not associated directly or indirectly with any Islamic Center or Organization.

12. Does LARIBA Cost More than Riba Banks? Does LARIBA charge High Fees?

NO! We strive to be competitive with Riba-Free Banks and Mortgage Companies. Please BE CAREFUL of the “Bait and Switch” techniques used by others in the industry.

The administration fees charged by LARIBA are extremely competitive with other providers. There are no partnership fees, no hidden fees, no charges for research

13. How long does it take to get pre-approved?

It takes around 3 days to get pre-approved and usually much less if your application is complete. The application is available on the LARIBA site www.LARIBA.com. It usually takes as little as three weeks to close and usually 6 weeks. In case of emergency, we can do our best to help you because we do our underwriting and decisions in our offices.

14. What happens if I wish to sell the House?

The title of the house is registered in your name from day one. You can sell the house any time you wish to. You keep the capital gains. In the event there is a loss, then it will be a loss of up to your equity only without risk for the rest of the financed amount to the investor.

15. Does LARIBA participate in the Profit & Loss as Islam Orders Us?

YES.

We DO NOT participate in capital gains because the TITLE of the House is in your name. However, we participate in the loss potential:

16. What happens if I lose My Job?

You are given a grace period that varies depending on the situation. We shall do our best – if justified - to help you stay as a dignified member of the community. If, God forbid, you could not get another job, we work with you to sell the house. If you make money, then it is yours. If you lose money, then it is our risk.

17. Can I Renegotiate my Payments with LARIBA in Terms of Increasing or Decreasing the Monthly Payment? Is there a cost involved? And if so, why?

YES.

You can pre-pay at any time with no cost.

18. Do I still get the Tax Benefit as from a Traditional Mortgage?

YES.

19. How Does LARIBA Get Its Financing? Is It From A Muslim Investor?

LARIBA is a Registered Finance Company that is owned by members from the American Muslim Community. They put their money where their mouth is.

LARIBA did not go hat-in-hand trying to collect funds from the rich and affluent in the Oil rich countries. Our Policy is to rely on our own local resources.

There are three Sources of funding:

Please understand that in order to finance 10 homes per month at $200,000 each, the company should have at least $20 million available every month or at least $240 million per year. This is a staggering number for our community to afford. That is why we thank God for making Freddie Mac / Fannie Mae our major investors in addition to others in our community who have chosen to support this grass root community effort.